#TalkMoneyWeek - Pensions Top Tips

- Anglia Care Trust

- Nov 4, 2024

- 2 min read

Here are our Money Adviser Stuart’s top tips:

Start saving into a pension scheme as early as possible as this gives the pot more time to grow.

Most young people start to think of saving into a pension after they have bought a house or had children as they think these things are more important. Don’t leave it that late.

Start with small contributions if you need to, putting a small amount in early is better than leaving it later and having to put more in.

Make additional payments to an employer’s scheme, as most employer’s schemes will only provide a top up to the state pension.

Anyone who is self-employed should consider paying at least class 2 National Insurance contributions in order to keep the state pension for retirement but seek advice.

The older you are, and nearer to retirement, the more you should pay into a retirement fund, if you are able to.

There are other ways to fund retirement for lump sums as well as income such as ISA’s.

Check what age you can claim your state pension Check your State Pension age

Check your national insurance record which affects the state pension you will get Check your National Insurance record

The best time to start saving into a pension for most people was ten years ago, but the second best time is today!

Take a look at your pension provision, or consider Stuart's advice if you haven't. Chat to your family, friends and colleagues - #talkmoney week is a great to get chatting and finding out more - #DoOneThing

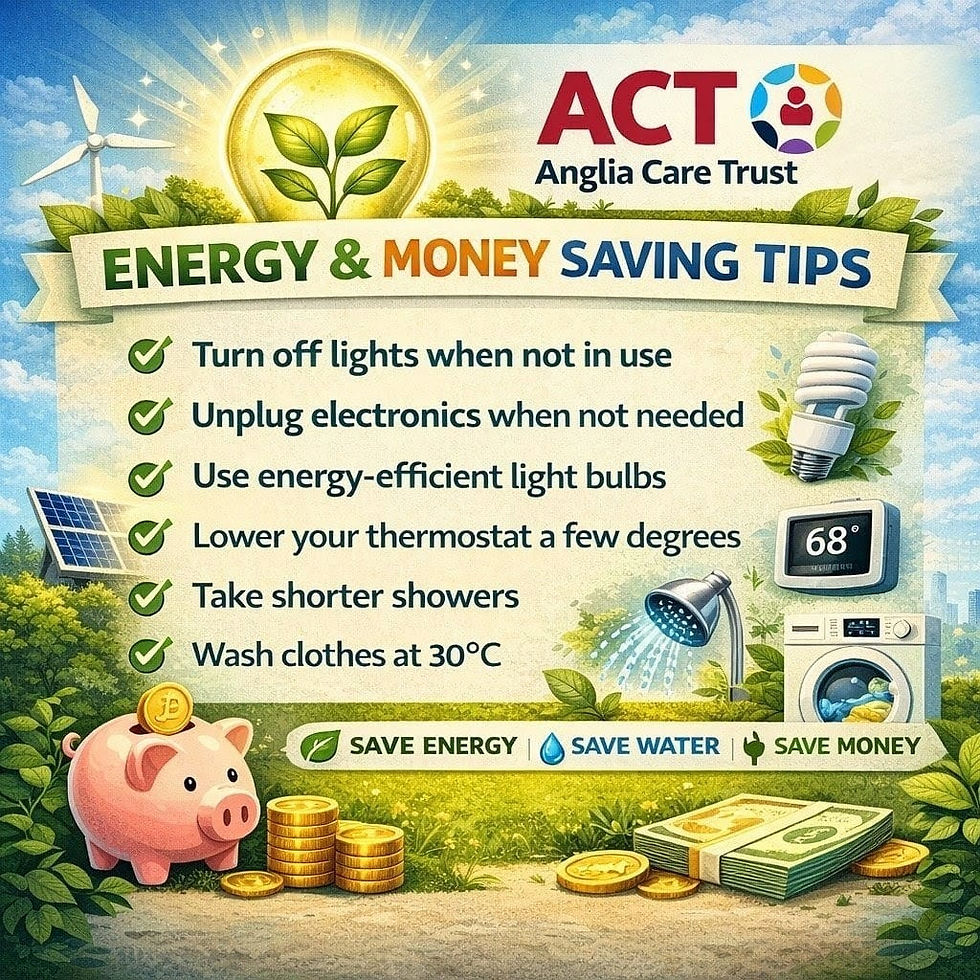

For lots of money-saving tips, also download our FREE 'reducing everyday living costs' booklet and start saving today

Comments